|

|

|

|

|

|

|

|

|

|||

|

|

|

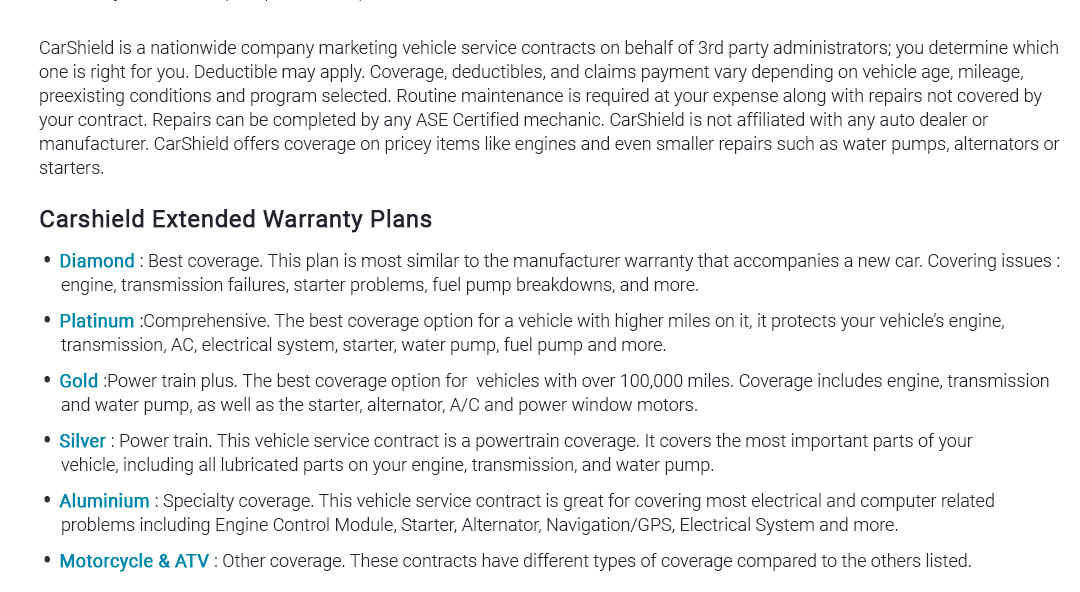

|||||||

|

|||||||

|

|||||||

|

|||||||

|

|||||||

|

|||||||

|

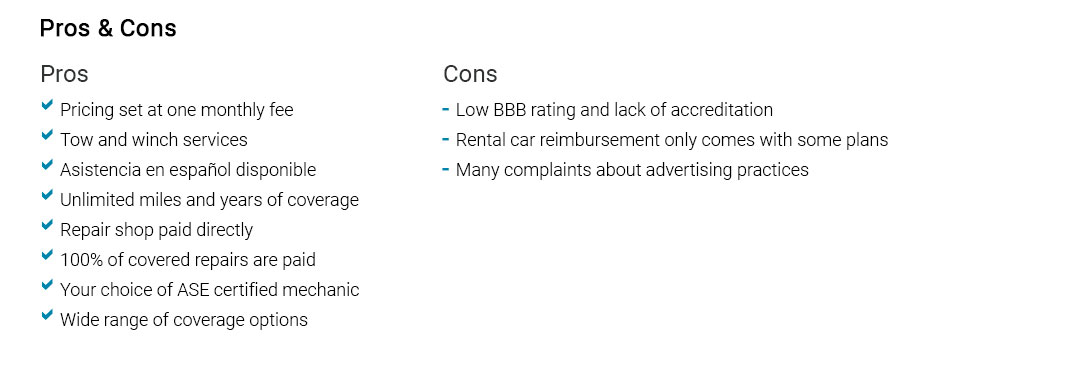

||||||

|

||||||

|

||||||

|

||||||

|

|

|

|

|

|

|

|

gap insurance companies: choices, fairness, and offers in real lifeWhat gap coverage really fillsGap coverage bridges the space between a vehicle's actual cash value and what a borrower still owes after a total loss. Different gap insurance companies approach that bridge differently - some are traditional insurers, some sit inside lender programs, and some come through dealership finance menus. Each claims to be simple. It mostly is, until a claim tests the small print. How companies differ

A small moment from the counterIn a quiet corner of a suburban showroom, I watched a buyer named Maya compare two gap offers: the dealer's flat-fee contract and her lender's add-on. The dealer plan included deductible coverage but had a lower payout cap; the lender version capped higher but skipped deductibles. She asked for the terms in writing, circled the cap, and picked the lender's deal. Months later, a hailstorm totaled her crossover. The payout wiped the balance except for taxes and a small fee - gap covered most of it. Her refund after early payoff came, smaller than she expected; a processing fee trimmed it. She wasn't upset, just mildly surprised, and said she might have read that line twice. Pros

Cons

Evaluating with an eye for fairness

A softer truthMost gap insurance companies aim for fairness, and many do fine by it. Yet numbers move - values, fees, and timing - so the clean lines can blur at the edges. That's not a reason to skip coverage; it's a nudge to compare offers, get promises in writing, and keep copies of everything. The best fit is the one that clears your balance without fuss and doesn't charge more than the risk is worth. https://wallethub.com/edu/ci/best-gap-insurance/94139

Best Gap Insurance Companies - Travelers Insurance. Travelers Insurance. Rating, 2 out of 5 694 Reviews (694) - The Hartford. The Hartford. Rating, 2.5 out of 5 ... https://www.progressive.com/answers/buying-gap-insurance/

You can typically add gap coverage to an existing car insurance policy or a new policy, as long as your loan or lease hasn't been paid off. Buying gap insurance ... https://easycare.com/other-vehicle-coverage/guaranteed-asset-protection/

Our Guaranteed Asset Protection (GAP) coverage protects you from paying large out-of-pocket expenses for the gap between your insurance settlement and the ...

|